Gifts of Real Estate

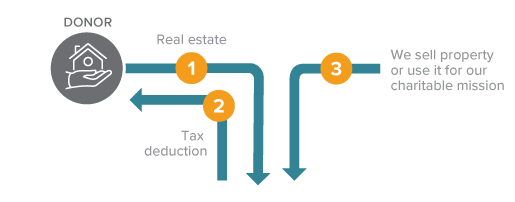

How It Works

- You deed your home, vacation home, undeveloped property, or commercial building to the American Cancer Society.

- The American Cancer Society may use the property or sell it and use the proceeds.

Benefits

- You receive an income tax deduction for the fair market value of the real estate.

- You pay no capital gains tax on the transfer.

- You can direct the proceeds from your gift to support the overall mission of the American Cancer Society.

Next

- You can donate your property yet continue to use it.

- Frequently asked questions on gifts of real estate.

- Contact us so we can assist you through every step.